START A TECHY

FRANCHISE TODAY

TECHY IS AN INTERNATIONAL

COMPANY WITH OVER HUNDREDS OF

LOCATIONS WORLDWIDE.

Your New Business

Partnering Up With Techy Means You Have A Step-By-Step Guide On Owning And Operating A Profitable Tech Franchise Store.

TECHY FRANCHISE OPPORTUNITY WILL GIVE YOU:

- Training classes to provide expert repairs and exceptional customer service

- Partnership with giant retailers that can help drive traffic to your store

- Support for finding the right team that can assist with daily operations

CHOOSE YOUR TECHY PACKAGE

Every store package includes location buildout, setup, fixtures & furniture, merchandising, and starter

signage. We also provide training and franchisee support

TECHY STORE PACKAGE

- $10K In Parts & Accessories

- TechySave - Monthly Recurring Revenue

- Techy University - Training / Learning Center

- Fixtures, Furniture, and Tools

- Replacement Parts and Accessories

- Channel Letters and Window Graphics

- Social Media & Website Creation

- Two Weeks Training at Techy HQ

- One week training on-site at your location

TECHY DEVICE PACKAGE

- $30K In Parts & Mobile Device Inventory

- $20K In Extra Display For Additional Product

- TechySave - Monthly Recurring Revenue

- Techy University - Training / Learning Center

- Fixtures, Furniture, and Tools

- Replacement Parts and Accessories

- Channel Letters and Window Graphics

- Social Media & Website Creation

- Two Weeks Training at Techy HQ

- One week training on-site at your location

TECHY CAFE PACKAGE

- $30K In Parts & Mobile Device Inventory

- $50K In Coffee Equipment & Furniture With An Espresso Machine, Refrigerator, And More.

- $20K In Extra Displays For Additional Inventory

- TechySave - Monthly Recurring Revenue

- Techy University - Training / Learning Center

- Fixtures, Furniture, and Tools

- Replacement Parts and Accessories

- Channel Letters and Window Graphics

- Social Media & Website Creation

- Two Weeks Training at Techy HQ

- One week training on-site at your location

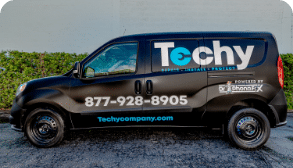

WRAPPED TECHY

VAN

- add-on for any package used for mobile repairs

- Advertising

- Smart home installs & more

- TechySave - Monthly Recurring Revenue

- Techy University - Training / Learning Center

- Fixtures, Furniture, and Tools

- Replacement Parts and Accessories

- Channel Letters and Window Graphics

- Social Media & Website Creation

- Two Weeks Training at Techy HQ

- One week training on-site at your location

BENEFITS OF TECHY FRANCHISE

No Experience Needed

We welcome all franchise owners that have an interest in our business. You will get A to Z training to know the details and fundamental aspects of running a Techy Store.

Strategic Marketing

Our talented in-house marketing team is dedicated to helping your business grow. They use multiple digitalchannels to promote our products and services.

Global Supply Chain

We help you keep your store fully stocked. You will have access to a network of vendors, including a 25,000 sq foot warehouse filled with over $4M of devices, tools, parts, and accessories

OUR COMPANY VALUES

You become a part of our family when you become a franchise owner. Our Techy 5 helps us become better for our business and in other areas of our lives as well.

01

SMILE

IT’S CONTAGIOUS.

02

03

WORDS ARE POWERFUL. KEEP THEM

POSITIVE.

04

YOUR COMPETITOR ALREADY HAS ONE.

05

OUR HISTORY

In 2006, two cousins, Tim and Bill, went into business together to open a store that sells smartphone accessories.

Their success sparked an interest in those who witnessed their growth. Friends, family, and employees wanted to get in on that success and own their own store.

Now, Techy has over hundreds of in the U.S. and is in 9 countries. Techy offers many services for various devices like computers, laptops, tablets, smartphones, smart home devices, and more. It’s an exciting time for Techy.

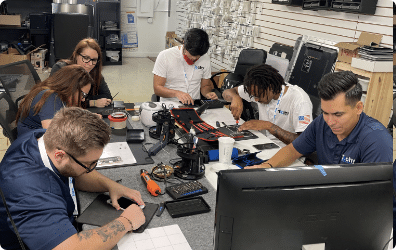

TRAINING FOR FRANCHISING

New franchise owners will get initial training to learn about our operation and the culture we cultivate in our Techy stores. We don’t just leave you hanging after you open your store. You’ll have access to unlimited training.

OPERATION SYSTEMS

Run your business efficiently with the right systems. We have a custom-built telephone system, POS system, and cloud access to make communication with the Techy team and customers go well.

OUR STATE-OF-THE-ART HEADQUARTERS

Our 25,000 sq ft Fort Lauderdale location is a hub for all our franchise owners. We love building a relationship with franchise owners everywhere. They are welcome to visit our headquarters to see how we support them in business.

Why Choose Techy

Techy provides many kinds of service and always tries to customer satisfied

- Repair Desk POS

- 100’s of Vendors

- Extra support

- Custom built in PBX

- In-house Distribution

- National Warranty Coverage

- National SEO

- Extensive training

- Retail e-commerce site (coming soon)

- Techy Save

- Techy Talks

- Micro-Soldering Support

- Discount on parts

- Techy University.

Join the Multi-Billion Dollar Electronic Repair Industry

Who's a good fit to purchase a TECHY

PHONE CARRIERS

MULTI UNIT

franchises

DEVICE REPAIR

STORES

Entrepreneurs

THE TECH EXPERIENCE

Hear what our franchisees are saying about Techy

OUR AMAZING EMPLOYEES

Kyle Brunette

Vice President of Operations

Nicole Cooper

Director of Franchise Sales

Rose Kelly

Director of Launch Services